In my last newsletter in late October, I suggested that despite data indicating the possibility of a slowing real estate market, it was too soon to tell. It may still be too soon – but the evidence is mounting.

Notably, we’re seeing evidence of a slowdown across the Bay Area and, indeed, nationally. The December 1 issue of The Economist describes a national “housing wobble”, citing declining new construction and higher interest rates as among the contributing factors. Nationwide, sales of existing homes were down 5.1% from the year previously and sales of new homes were down by 12%. (interestingly, the article suggests that declines in residential purchases and homebuilding are a leading indicator of recessions, rather than the other way around.)

The message was much the same at the UC Berkeley Real Estate Symposium which I attended last month, where keynote speaker Ken Rosen — advisor to billion dollar REITs and foreign governments – opined that “we are late in the cycle.” Locally, he thinks that we’ll need to wait till the Spring to see if higher interest rates, lower tax deductions, and an increasing number of people who are looking to move out of the Bay Area because they’re fed up with congestion and high prices will lead to a meaningful “correction” in home prices.

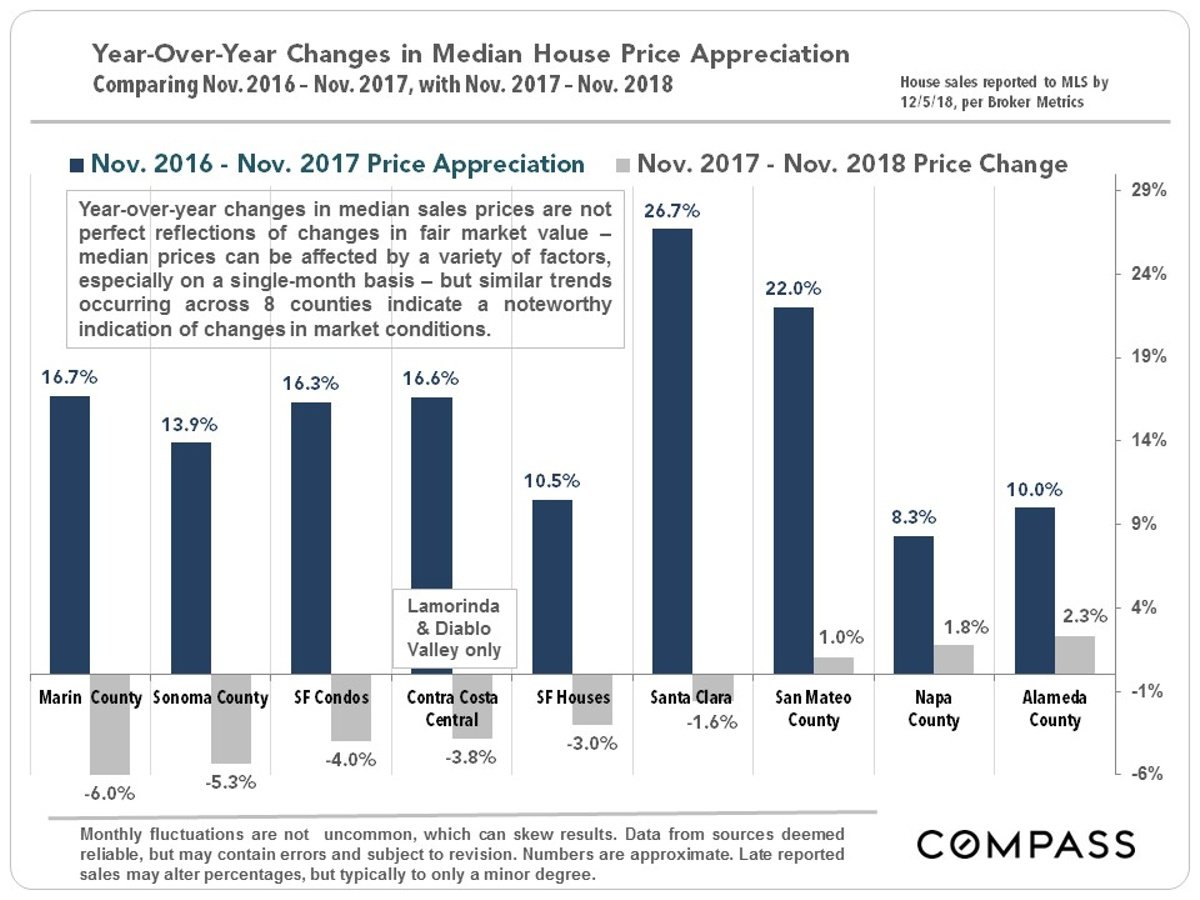

As the chart below shows, there’s been price erosion in most Bay Area counties over the last year.

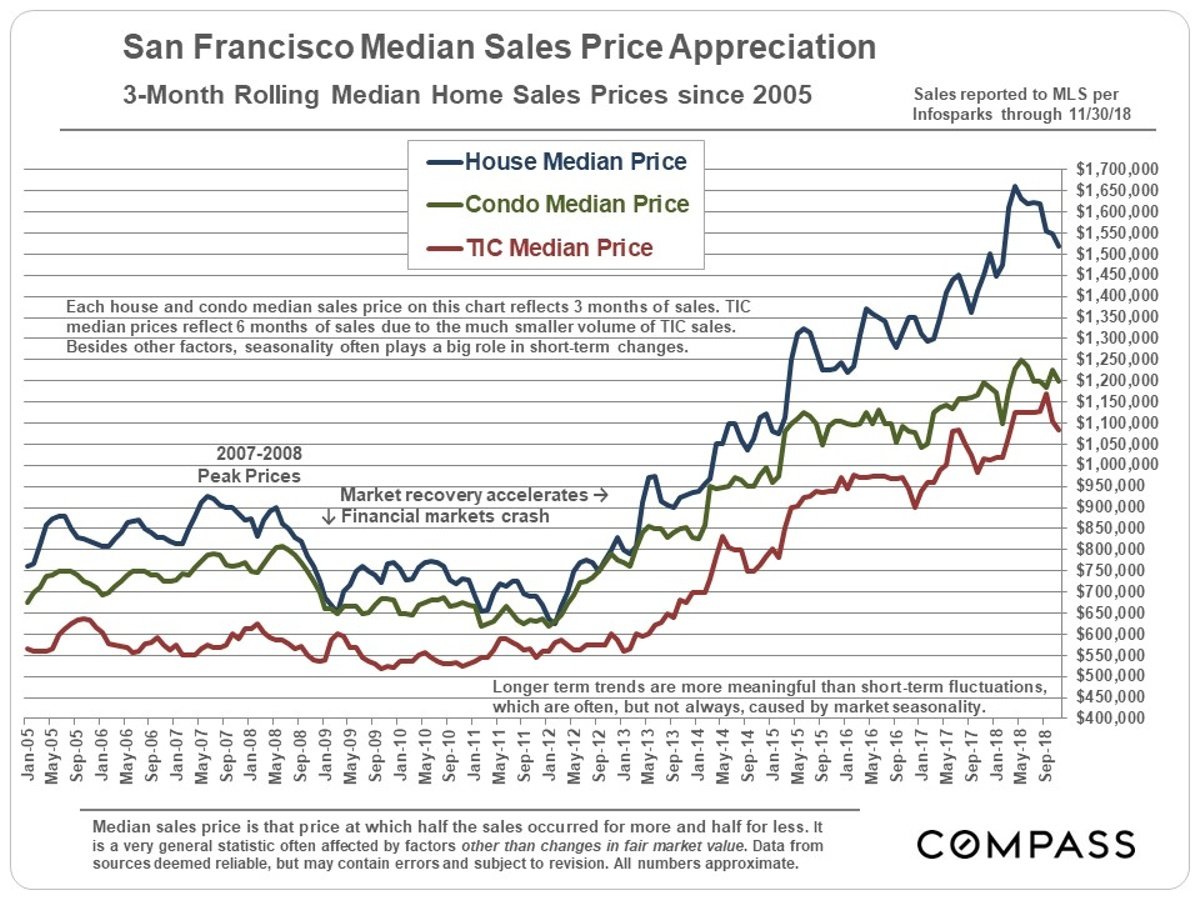

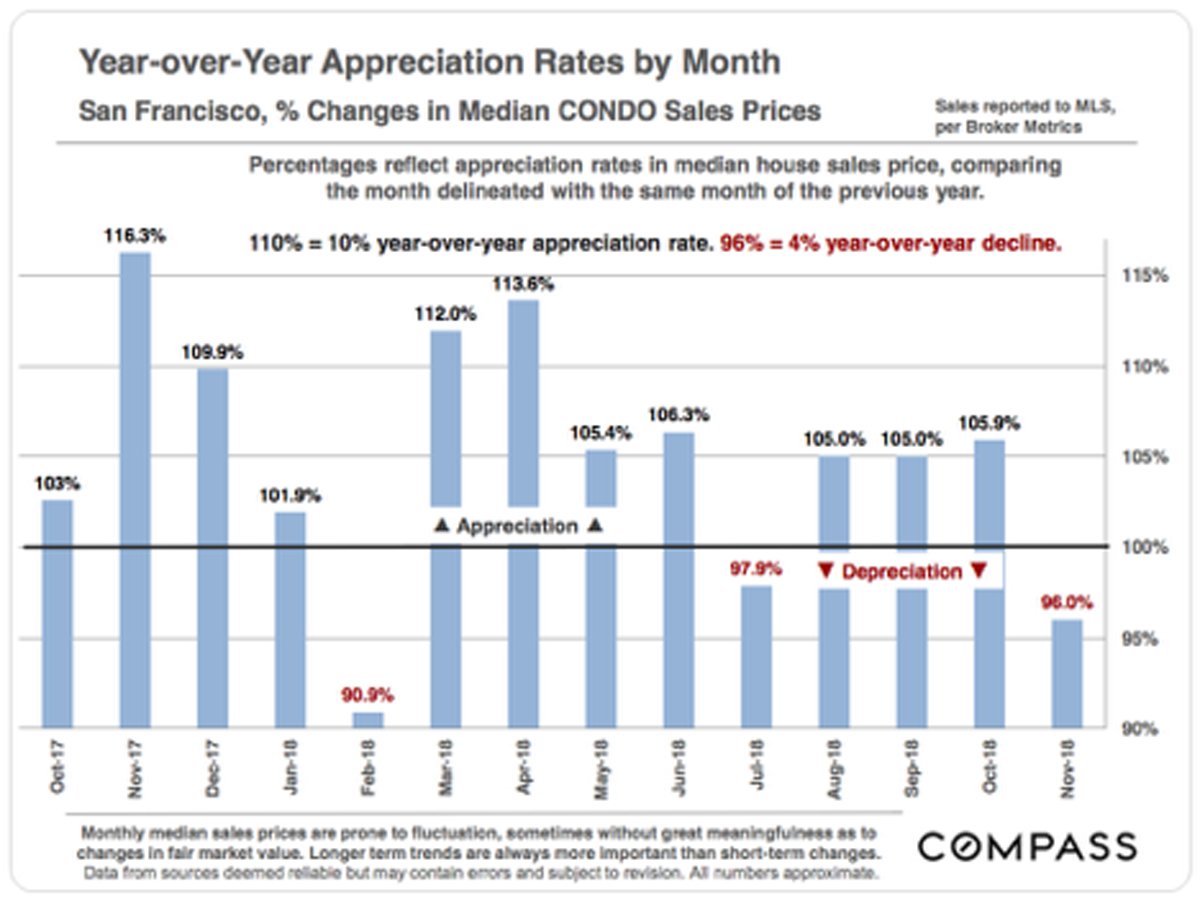

And in San Francisco, home prices had a big bump in the Spring, but have fallen back since then. Note that the chart below tracks three month rolling averages, so I’d expect further price declines to show up as we move past the seasonally strong months of September and October.

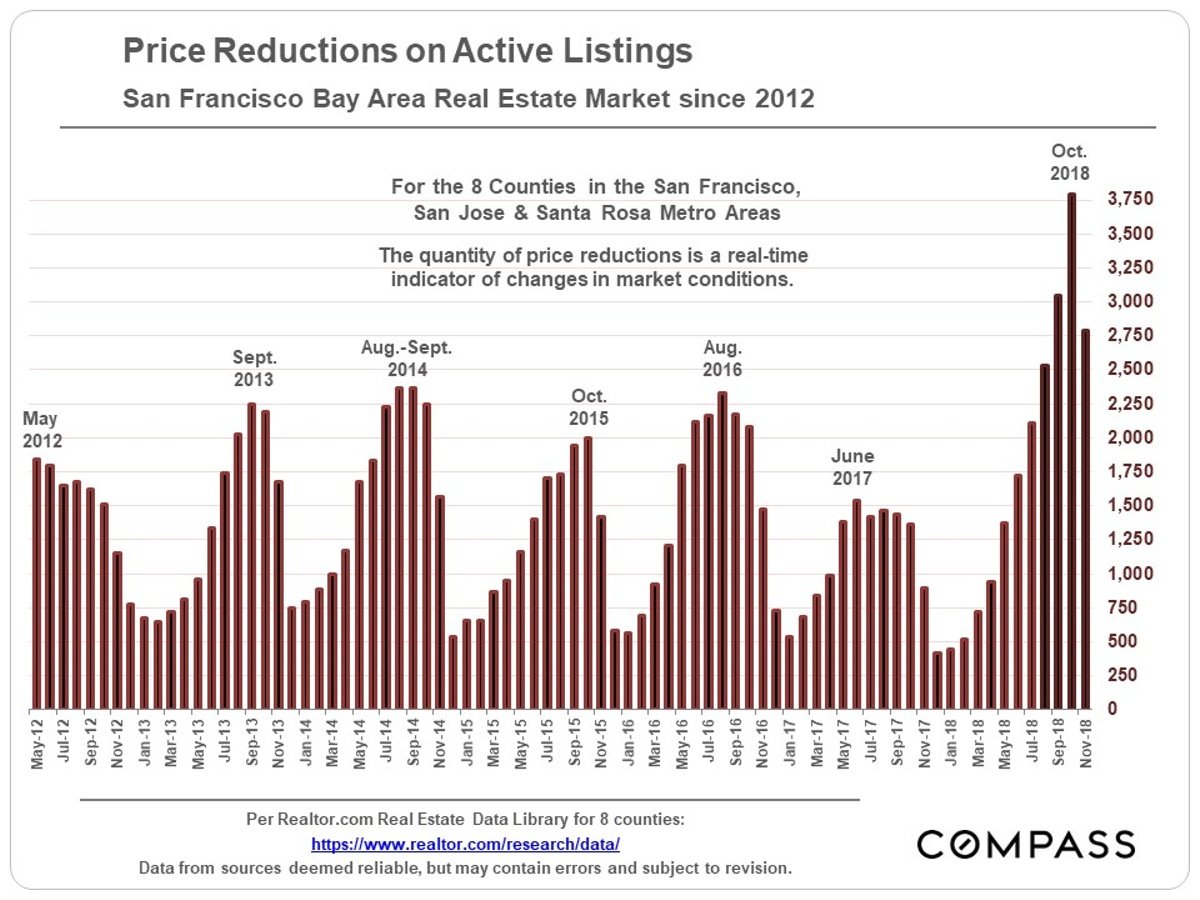

Meanwhile, price reductions on active listings in the last couple of months are up well above previous years and so seem to be showing more than the usual seasonal increase we expect towards year’s end.

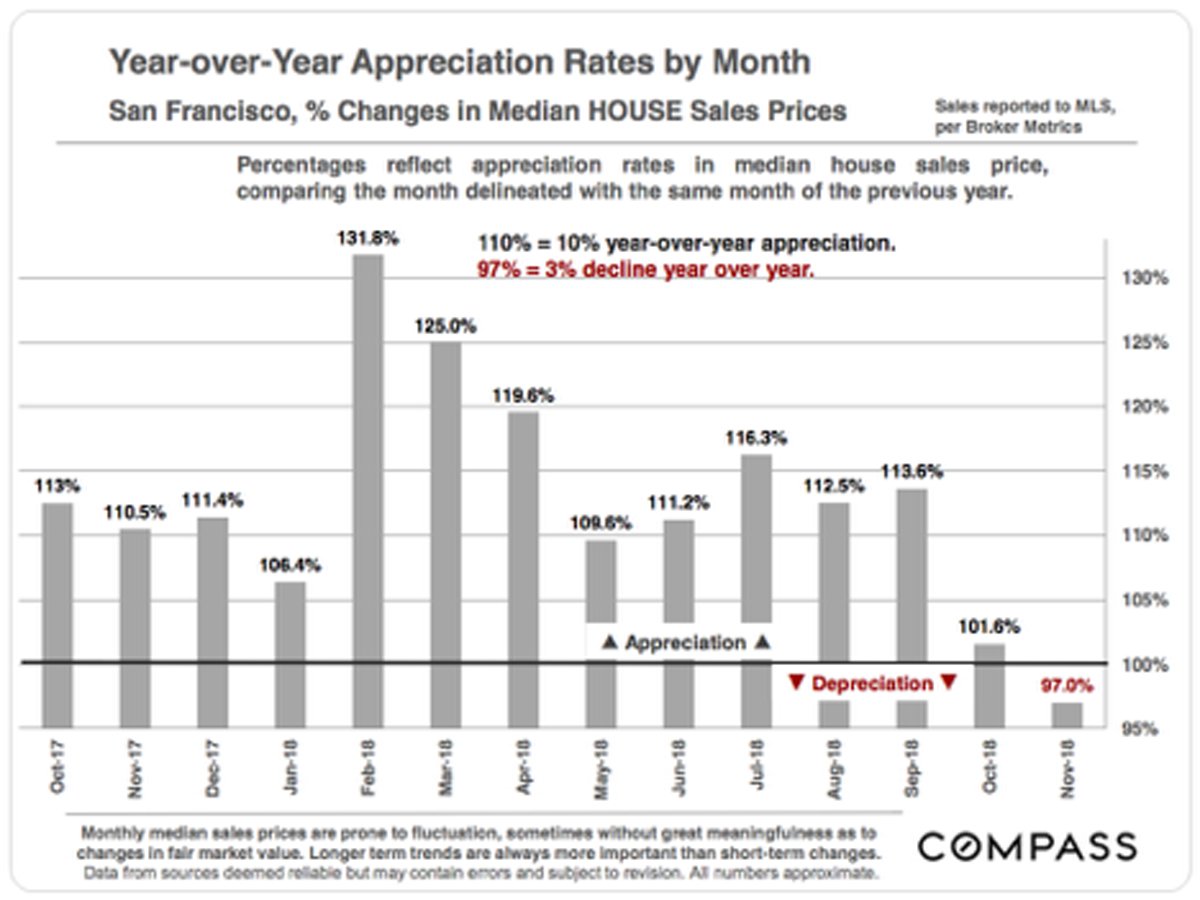

Let’s be clear, however: 2018 has been a very good year for San Francisco home sellers, with solid year over year price increases until very recently, especially for single family homes (see charts below). So it remains too soon to predict whether we are witnessing a “wobble,” a seasonal pause, or the start of a meaningful decline in home prices.

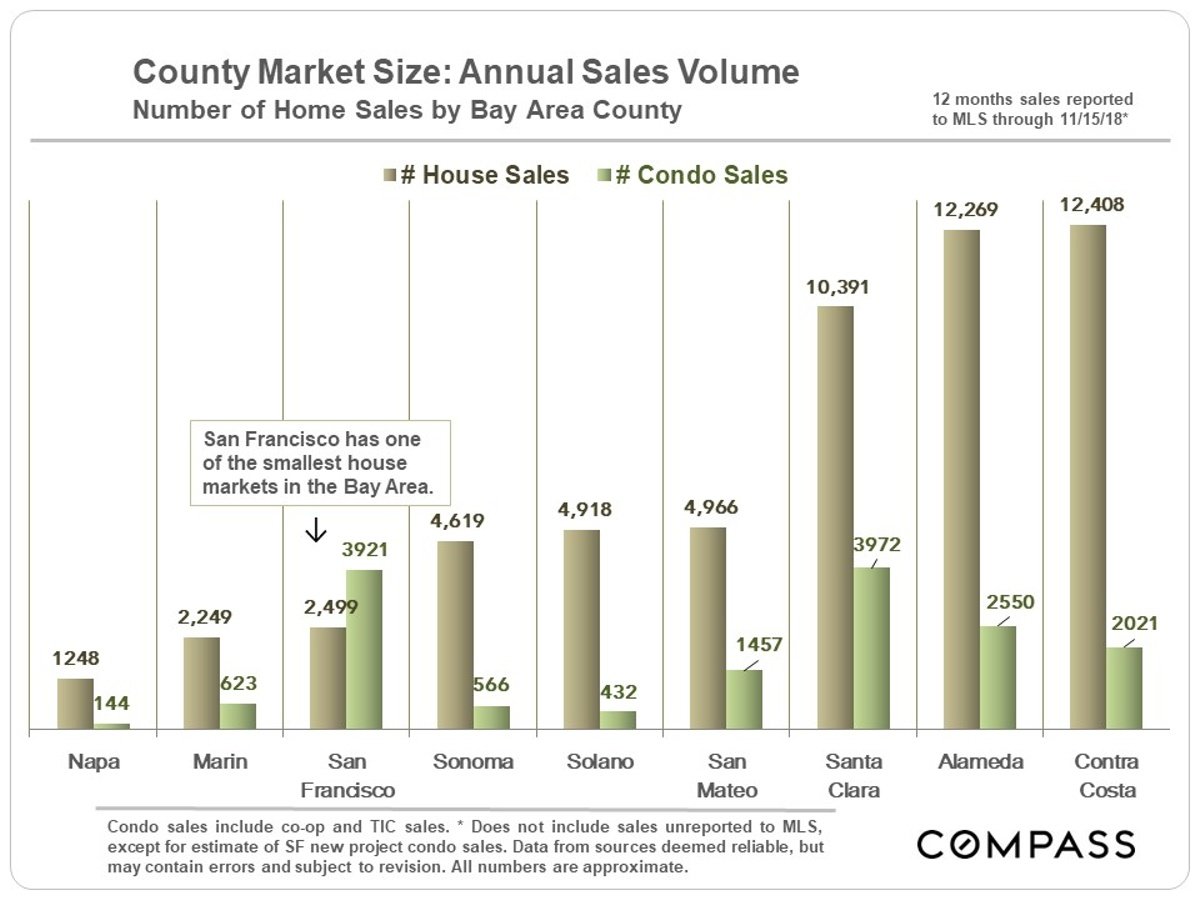

In addition, with a handful of Unicorns (Uber, AirBnB, Lyft) moving up their timelines for going public, there could be several hundred newly minted millionaires vying for higher end homes. In a market where we estimate there are only about 2,500 single family home sales per year, these buyers could provide substantial support for home prices.

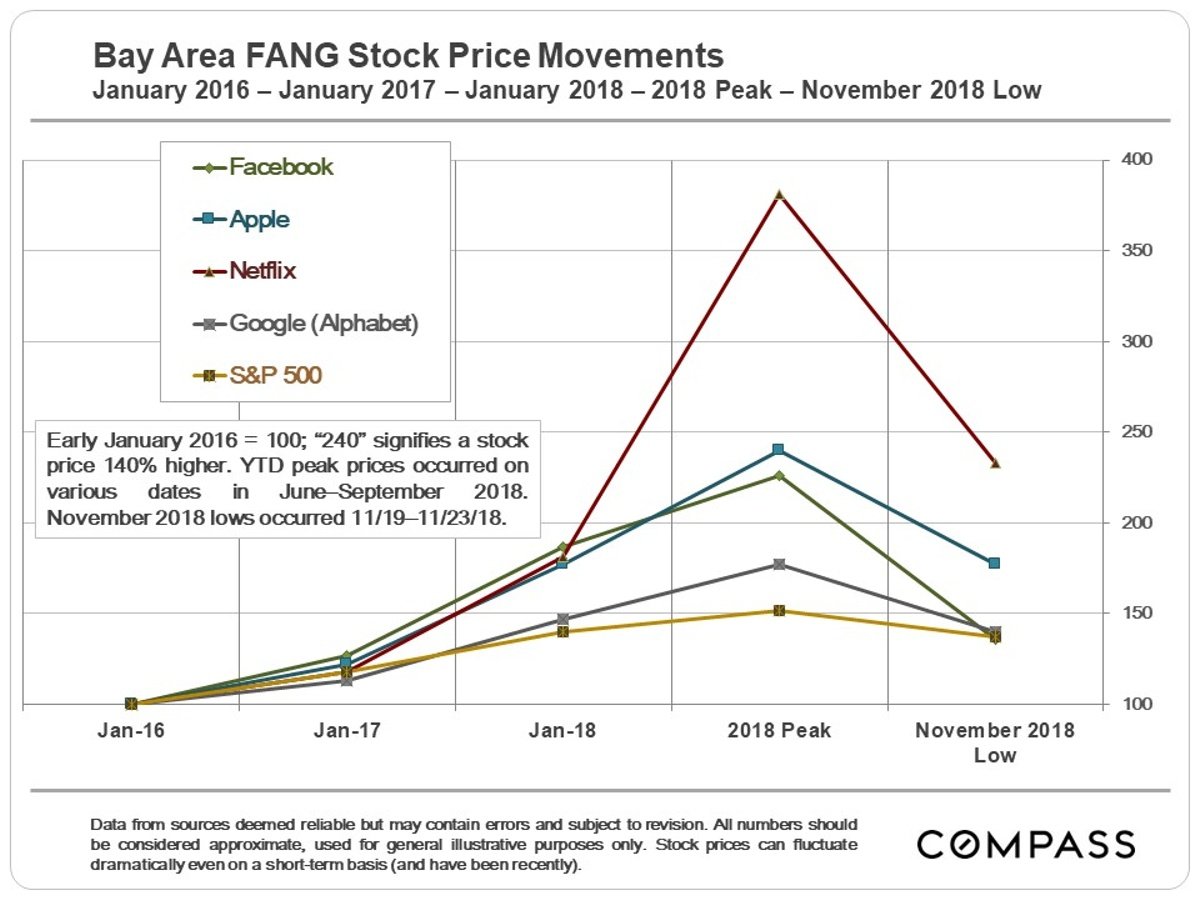

At the same time, with the recent hard decline in the stock market — and in Bay-Area tech stocks in particular – many people may be feeling a lot less wealthy.

How all these vectors ultimately intersect is anybody’s guess. Personally, I think a market balanced more evenly between buyers and sellers would be a good thing. Sure, maybe sellers would prefer the breathtaking price acceleration and frenzied multiple offer market of recent years to continue, but, as we saw in the Great Recession of 2007/2008, that sort of market tends to end up with an equal and opposite effect down the road. I’ll take a slowdown over a crash any day.

As always, your comments, questions and referrals are much appreciated! And Happy Holidays to all my readers!

Misha