I don’t mean to sound alarmist – well yes I do – but there’s a California ballot measure up for vote this November that could significantly curtail your rights as an owner of a single family house or condominium if you should ever decide to rent it out.

Most people are aware that San Francisco has rent and eviction control legislation. Briefly summarized and simplified, if you own a multi-unit building (ie. two units or more) which was completed prior to the date the Rent Ordinance was passed, June 13, 1979, you cannot increase the rent of an existing tenant by more than 60% of the annual Consumer Price Index each year. In addition, you can only evict a tenant for a limited set of reasons enumerated under the Ordinance. In practical effect this means that a lease for a fixed term has no meaning: once the lease is up, a tenant who is otherwise paying rent on time can stay as long as she wants to stay. And, for as long as she stays, the maximum annual amount that her rent can increase is determined by the Rent Ordinance, not by you.

Now, some might support Rent Control as way to support affordable housing in the context of an apartment building. However, they might feel differently if owners of single family homes or condos are subject to the same set of rules as those that govern buildings with two, three, or thirty tenants.

That’s why Proposition 10 is important: it could mean that in the future San Francisco’s Rent Ordinance will apply to every kind of residential property in San Francisco, including single family homes and condos.

Costa-Hawkins Protects Single Family Homes and Condos from Rent Control

In February 1995, the California Legislature passed a law known as Costa-Hawkins that prohibited local governments like San Francisco from imposing rent control laws on single family homes and condominiums, while leaving rent control regulation on multi-unit buildings intact. The second important aspect of the legislation was that it prohibited the imposition of rent control on newly constructed residential buildings or, in the case of municipalities that already had a rent ordinance in place, buildings constructed after the date of the local ordinance. This “new construction” exemption was intended to allay fears that apartment developers would simply stop building in areas where rent control was in effect — thus exacerbating the housing crunch precisely in those areas that needed more housing.

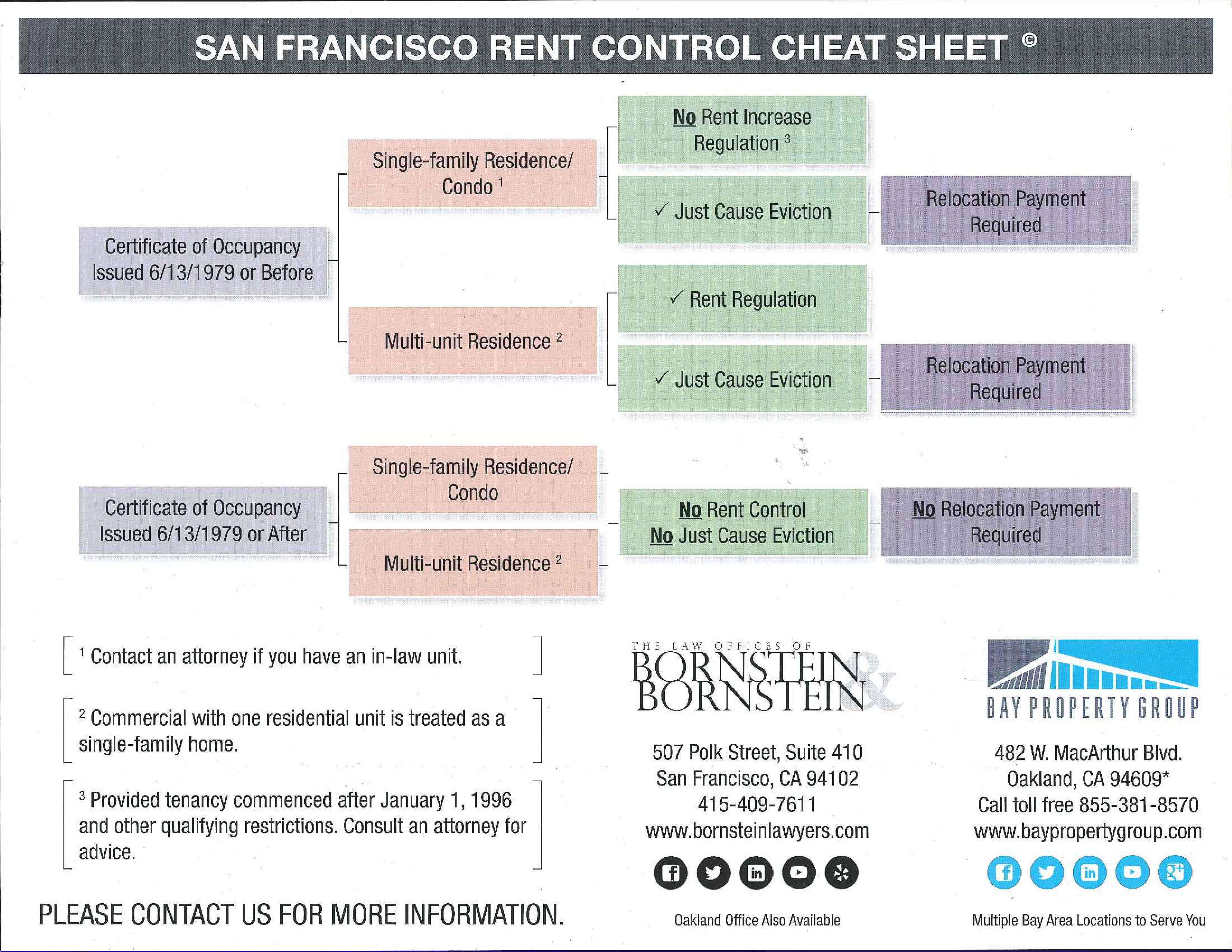

As a result of Costa Hawkins, if you own a home or a condo in San Francisco and you decide to rent it out, it is not subject to rent control – regardless of when it was built. As for eviction control, it depends on whether the home or condo was built before or after June 13, 1979, when the Rent Ordinance was passed. If built before, it is subject to eviction control; if built after, it is not. Complicated? You bet. Here’s the best graphic I’ve found to describe how things work now, courtesy of the law firm of Bornstein & Bornstein.

Other important and potentially expensive ramifications follow from whether a property is or isn’t subject to rent control and/or eviction control. I’ll briefly touch on one – Relocation Payments – which are mentioned in the chart. Say you’re thinking of buying a condo in a building constructed in 1925. The condo is occupied by a couple with a school-aged child whose original lease has expired and who are now protected from eviction under the Rent Ordinance. You want to move into it yourself. This is called an “Owner Move-In Eviction.” The Rent Ordinance controls every aspect of this process, including: when you can evict the tenant (not during the school year); how much notice you need to give them; and the amount of the “Relocation Payment” you’d be required to pay (for this family, it’s about $25,000 and goes up from there depending on particular circumstances). Take the same situation but imagine that you’re looking to buy a condo in a new high-rise: none of those same requirements currently apply.

Prop 10 Would Repeal Costa-Hawkins

Prop 10’s purpose is to repeal Costa-Hawkins and to leave it to local governments to decide which kinds of properties are subject to rent and eviction control. For example, San Francisco could extend its Rent Ordinance to most or all of the residential properties that are currently exempt. Here’s what the Law Firm of Steven Adair MacDonald wrote in its recent bulletin about Prop 10: (Please email me for a copy.)

“If Costa-Hawkins were repealed, local governments could create or expand their existing rent and eviction control ordinances so that all residential units, including, new apartments, single family homes, and condos, are treated alike. Vacancy control could also be implemented, which would limit what a landlord can charge when a unit becomes vacant.

Are such additional regulations likely in San Francisco? I offer Exhibit A: In June 2018, San Francisco voters passed Proposition F by a 56% margin. It requires the City to provide free legal representation to every tenant that is served an eviction notice, regardless of the tenant’s economic means or the circumstances of the eviction.

While proponents of Prop 10 argue that it will give local government the power to protect and expand affordable housing, “opponents argue it will ultimately reduce the housing stock given that landlords can no longer get a reasonable return on their investment and will instead, opt to remove their units from the already shrinking housing market.” How do you “remove a unit?” You “Ellis Act” it. That’s a subject unto itself.

Will it Pass?

Proponents and opponents are both spending at a furious rate. While California’s home-ownership rate is 54% according to the US Census, a recent UC Berkeley study found that 60% of likely voters support rent control. I haven’t been able to find any current predictions on whether the measure will pass but given the general and understandable frustration about high rents in many parts of the state, I’d say that there’s a better than 50/50 chance that it will.

Why it Matters

It’s one thing to believe that the owners of multi-unit buildings who have chosen to be “in the business” of owning residential income property should be subject to rent control legislation. It’s quite another to apply those same regulations to someone who originally bought a home or a condo for their own use and who then later decided to rent it out. People move away temporarily for work reasons and want to rent out their home to cover the cost of their mortgage. Others want to “downsize” but get income from their home for their retirement. Others may simply want to eventually pass the home on to their children.

If Prop 10 passes and San Francisco extends its Rent Ordinance to homes and condos, perhaps more people will choose to sell once they no longer intend to occupy their homes or condos themselves. Others who can afford to may simply keep their homes vacant rather than subject themselves to the Rent Ordinance. Yet others, may think twice about owning property in San Francisco at all.

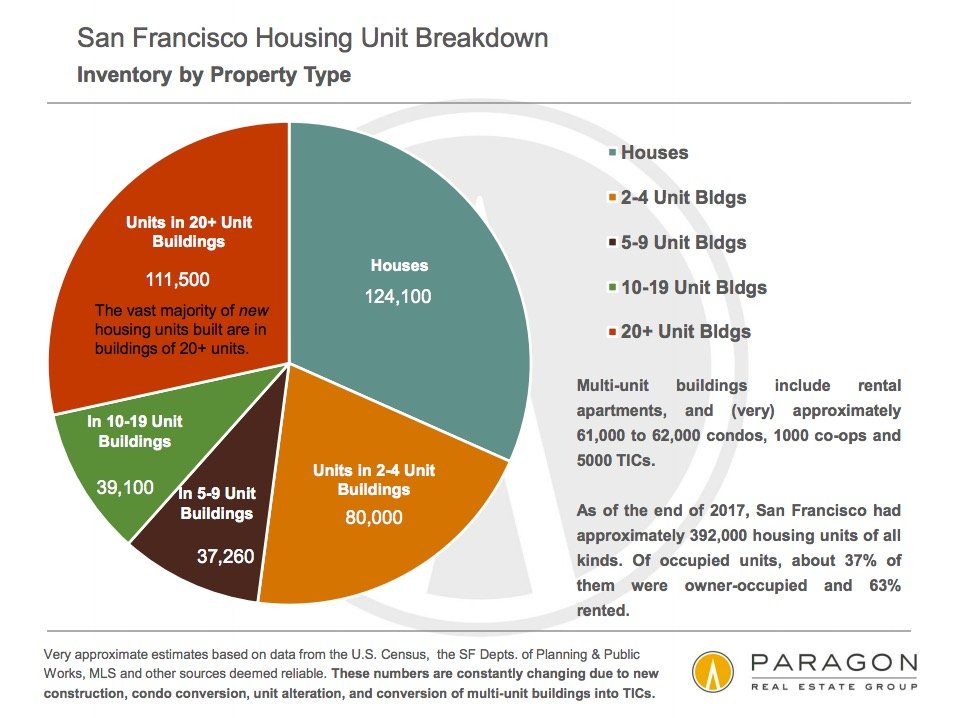

My purpose in this newsletter is not to bash rent control. Housing affordability is a real and complex issue. Is rent control a good policy solution? Academicians and economists seem on balance to think it is not, but I’m in no position to judge their conclusions. Still, considering that about 37% of SF’s 390,000 housing units are owner-occupied, I think it’s fair to say Prop 10 could have an enormous effect on San Francisco’s homeowners.

What to Do? Talk to an Attorney, Really

It should be abundantly clear by now that buying, selling or owning a property in San Francisco that is tenant-occupied – or even that has previously been tenant-occupied — can be a veritable legal minefield. If you own or are thinking of buying residential income property in San Francisco or elsewhere in California, I urge you to read this excellent non-partisan article about Proposition 10. Then sit down with an attorney that specializes in residential real estate law. Please call or email me if you need a referral.

For people who might be thinking about renting out their home or condo for a while – say, during a temporary relocation – again, I urge you to consult with an attorney and to consider delaying the rental until we see if Prop 10 passes. You might find that getting your home back when you want it is more difficult and expensive than you anticipated.

Thanks for your patience on this especially long newsletter. As always, your comments, referrals and suggestions are much appreciated.

[Note, this newsletter is not to be construed as legal advice on any of the matters discussed within it and is intended for general informational purposes only.]

Excellent article… I agree with your analysis. Politicians are not economists, evidently.